The Opportunity—and the Challenge

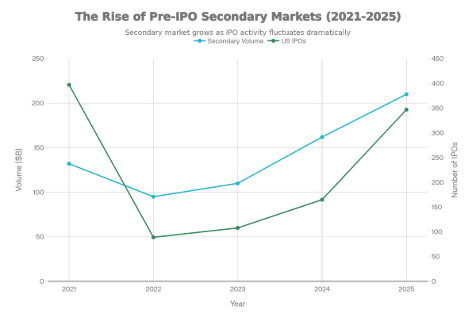

The pre-IPO investment landscape has transformed dramatically. Secondary market transaction volumes surged to a record $162 billion in 2024, with projections exceeding $210 billion in 2025—a trajectory that reflects both the maturation of private markets and the extended timeline companies now remain private before going public.

$210B+ in secondary market deals (2025)

$70M+ in SEC fraud charges (2025)

74% of investors skip certificate verification

The difference? A systematic due diligence framework.

For accredited investors, this creates unprecedented access to high-growth companies at late stages of development, companies that previous generations of investors could only access after their public debuts. Yet opportunity without expertise invites risk. This growth has been matched by a rise in enforcement actions against pre-IPO fraud, which is why this article is essential.

At Opulentia, due diligence is not a checklist to complete—it is the core competency that protects capital and identifies asymmetric opportunities. This guide distills the evaluation framework that informs every pre-IPO investment decision, empowering investors to understand not only what is analyzed but also why each element matters.

The Risk Landscape: Why Fraud Prevention Comes First

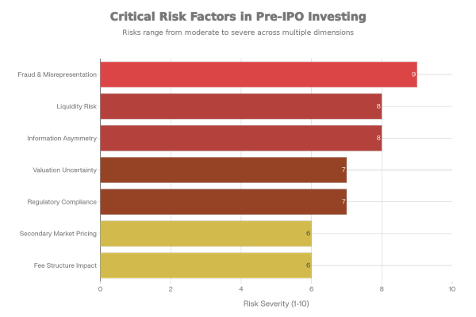

Public equity investors operate in mandated transparency—quarterly earnings, SEC filings, analyst coverage, and real-time pricing. Pre-IPO investing is fundamentally different: information is scarce, liquidity is limited, and pricing is negotiated rather than market-discovered. This opacity creates a distinct risk hierarchy.

This opacity creates the risk hierarchy that defines pre-IPO evaluation:

Fraud and misrepresentation rank highest because the stakes are binary—illegitimate transactions result in a total capital loss.

For this reason, transaction authenticity must be treated as a hard gate:

- Certificate verification: Physical or digital certificates reviewed against company and transfer-agent records, matching protocols used by institutional secondary platforms

- Transfer agent confirmation: Direct validation that sellers own shares and have legal transfer rights

- Rights review: Identification of lock-ups, rights of first refusal (ROFRs), and contractual restrictions before capital deployment

- Broker-dealer verification: FINRA registration and disciplinary history checks filter unregistered promoters

A Five-Stage Due Diligence Framework

Once authenticity is established, a comprehensive evaluation follows a structured methodology examining the company, transaction structure, and portfolio fit:

Stage One: Company Fundamentals

Valuation multiples and term sheets are meaningless if the underlying business lacks durability. Fundamental analysis begins with three core questions:

Business Model Validation: Can the company scale profitably? Analysis examines cohort economics—whether newer customers show improving or deteriorating unit economics relative to earlier cohorts. Revenue growth rates, gross margins, and sales efficiency metrics can be benchmarked against public comparables to assess whether performance is exceptional, in line, or lagging relative to peers at similar stages.

Management Team Assessment: Pre-IPO companies are organizations in transition—moving from founder-led execution to institutionalized systems and processes. The management team must demonstrate both strategic vision to identify market opportunities and operational discipline to build scalable organizations. Founder backgrounds, prior exits, domain expertise, and leadership composition provide indicators of execution capability. Reference calls with former employees, customers, and investors provide qualitative insights that financial statements cannot capture.

Competitive Positioning: Does the company have structural advantages to defend margins as markets mature? Network effects, switching costs, proprietary data, and brand equity create defensible moats that insulate companies from competitive pressure. Absence of these moats suggests current growth may not be sustainable.

The key question isn't whether competitors exist—it's whether the company can sustain competitive advantage as markets mature.

Stage Two: Financial Analysis & Valuation

Financial analysis in pre-IPO investing requires adapting public-market frameworks to the constraints of private companies. Late-stage companies may provide GAAP financials, but earlier-stage firms often provide management-prepared statements that lack audit verification. Valuation data are sparse—funding rounds occur infrequently, and secondary-market pricing may reflect seller urgency rather than fundamental value.

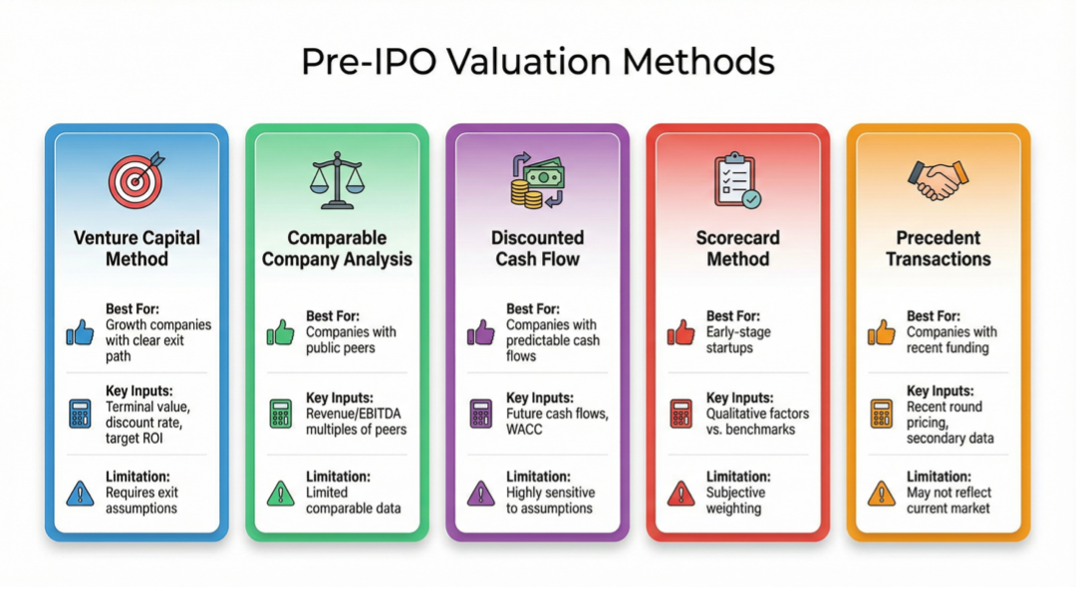

Valuation Methodologies

No single valuation method is definitive for private companies. Robust analysis triangulates across multiple approaches, each with distinct assumptions and limitations:

The Venture Capital Method anchors valuation to projected exit events, working backward from assumed exit valuations (based on comparable IPO multiples or M&A prices) and discounting to present value using risk-adjusted rates. Sensitivity analysis across bull, base, and bear case scenarios is essential for understanding the range of outcomes.

Comparable Company Analysis provides market-based validation by comparing the target company's financial metrics (revenue, EBITDA, growth rates) to public companies in the same sector.

Discounted Cash Flow analysis values companies based on projected future cash flows, discounted to present value using a weighted average cost of capital.

Beyond Entry Price

Valuation analysis assesses whether entry price offers sufficient upside relative to risk—a company fairly valued at $5B may be unattractive at $4.5B, while a $10B company may be compelling at $7B with clear paths to $20B+. Secondary market pricing reflects seller urgency, information gaps, or structural factors, with typical discounts of 20-30% relative to last primary rounds. Steeper discounts warrant an investigation into the company's performance or impending down rounds.

Stage Three: Legal & Compliance Review

Legal structures determine both the rights investors receive and the risks they assume. A surface-level review focuses on whether shares are common or preferred; an institutional-grade analysis examines the full capital structure, governance rights, and regulatory compliance posture.

Cap Table & Share Class Analysis: Companies raise capital across multiple rounds, each with distinct terms. Preferred stock typically includes liquidation preferences (investors receive a guaranteed return before common shareholders receive anything), anti-dilution provisions (protection against down rounds), and board representation rights. Common stock lacks these protections, which is why it typically trades at a discount to preferred stock even though both represent ownership in the same company.

For investors purchasing common shares on secondary markets, understanding the preference stack is critical.

If a company raised $500 million in preferred equity with a 1x liquidation preference, common shareholders receive value only after the first $500 million of exit proceeds are distributed to preferred holders. If the company exits at $400 million, common shareholders receive zero.

This isn't hypothetical—it's the structural reality of how capital stacks work.

Analysis revealed: common shares 'worthless" on exits below $800M. The 30% secondary discount wasn't a deal—it was market pricing in risk.

Outcome: PASS. Despite the "hot" sector.

Transfer Restrictions & Rights: Private company shares aren't freely tradable. Transfer restrictions serve legitimate corporate purposes—preventing securities law violations, maintaining cap table cleanliness, and giving existing investors visibility into ownership.

Rights of first refusal (ROFR) give the company (and sometimes existing investors) the right to purchase shares before they can be sold to third parties. This process adds time—often 30-60 days—and introduces uncertainty, as the company may exercise its right and block the transaction. Some ROFRs are administrative formalities; others are defensive mechanisms to prevent unwanted shareholders.

Lock-up agreements prohibit investors from specified periods, most commonly 6-12 months following an IPO. If an investor purchases shares six months before an expected IPO, the lock-up period may extend liquidity by an additional 6-12 months beyond the IPO date. This affects return calculations and liquidity planning.

Tag-along rights (co-sale provisions) allow minority shareholders to participate in sales by major shareholders, preventing situations where control shareholders exit at premium prices while minorities remain illiquid. Drag-along provisions, conversely, require minority shareholders to participate in sales approved by supermajority votes, ensuring small shareholders cannot block value-maximizing transactions.

These provisions are found in shareholder agreements, investors' rights agreements, and corporate bylaws. Reading and understanding them is not optional.

Beyond the preferred-versus-common distinction, not all preferred shares are equal. In standard liquidation structures (72% of VC deals), preferred shareholders are paid in reverse chronological order—Series G before F before E, down to Series A, then common stock. An investor purchasing Series A shares at a 20% discount to the current Series G price may still be overpaying if the company has raised billions in intervening rounds.

Example: A company raising Series G at $350B with $26.5B in cumulative liquidation preferences (Series E, F, G) means Series A shareholders receive nothing in any exit below $26.5B—despite holding "preferred" stock. This is why early-round secondary shares trade at 20-40% discounts to the most recent primary—the market is pricing in structural subordination risk. When evaluating secondary opportunities, confirm where shares rank in the liquidation waterfall relative to the total preference stack.

Regulatory Compliance Verification: Private companies aren't exempt from securities regulation—they operate under exemptions permitting capital raises without SEC registration.

✗ Seller refuses transfer agent confirmation

✗ Broker-dealer not registered with FINRA

✗ Discounts >40% below the last primary round

✗ Missing or incomplete Form D filings

✗ Pressure to close "before the window expires."

✗ Certificate numbers don't match documents

In Conclusion (Part I): The Foundation of Due Diligence

Pre-IPO investing requires a fundamentally different analytical framework than public equities. The three stages covered in Part I—company fundamentals, valuation discipline, and capital structure analysis—form the foundation that separates legitimate opportunities from structural traps.

Key principles before deploying capital:

✓ Fraud prevention is non-negotiable. Certificate verification and transfer agent confirmation come first—74% of investors skip this step.

✓ Valuation requires triangulation. No single method is definitive. Combine the VC Method, comparables, and DCF to establish probability-weighted fair value.

✓ Capital structure determines risk. Liquidation preferences and round seniority—not just preferred vs. common—drive outcomes in disappointment scenarios. A Series A share at 20% discount may still be overpriced if subordinated to billions in senior claims.

What's Next: Execution & Portfolio Strategy

Understanding what you're buying establishes the analytical foundation. Part II complete complete the framework with transaction verification, exit-scenario modeling, and portfolio-construction principles that transform analysis into disciplined capital deployment.

Disclaimer: This article is for educational purposes only and does not constitute investment advice. Pre-IPO investments carry substantial risk, including the potential for total loss of invested capital, illiquidity, and long holding periods. Past performance is not indicative of future results. Investors should conduct their own due diligence and consult with qualified financial, legal, and tax advisors before making investment decisions.