The convergence of $447 billion U.S. defense market modernization, escalating global security tensions, and breakthrough manufacturing technologies has created a paradigmatic investment opportunity within the aerospace propulsion sector. Firehawk Aerospace represents the intersection of three accelerating mega-trends: the Pentagon's $25.2 billion annual commitment to AI and autonomous systems, the $3.77 billion hybrid rocket propulsion market expansion, and the strategic imperative for supply

chain resilience in critical defense technologies. With proprietary 3D-printed propellant technology that reduces production time from 60 days to just 7 hours while delivering 30-40% cost reductions and superior performance characteristics, Firehawk has secured $88.3 million in funding and demonstrated technological breakthroughs that position it as a strategic defense technology leader with compelling near-term value creation potential.

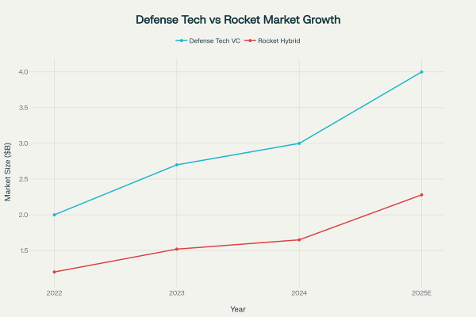

Figure: Defense technology venture capital funding and rocket hybrid propulsion market trends demonstrate strong growth momentum, with both sectors experiencing sustained expansion through 2025.

Revolutionary Technology Platform: Solving Fundamental Propulsion Limitations

The 3D Printing Breakthrough in Defense Applications

Firehawk's proprietary additive manufacturing approach fundamentally transforms solid rocket motor production by addressing historical limitations that have constrained hybrid rocket performance, specifically the low regression rates and limited mixing efficiency that plagued earlier designs. The company's 3D-printed fuel grains reduce production time from up to 60 days using traditional cast-and-cure methods to just 7 hours, while achieving measurable cost reductions of 30-40%.

The technical advantages extend far beyond speed and cost optimization. Firehawk's proprietary additive manufacturing process creates fuel grains with radial energy compositional variations, enabling customized performance profiles tailored to specific mission requirements. This capability addresses a critical defense need for mission-specific thrust profiles that can adapt to diverse operational scenarios, from tactical missile systems to reconnaissance platforms.

The company's Medium Area Additive Manufacturing (MAAM) platform represents industrial-scale production capability, incorporating thermoplastic-nanocomposite fuel systems and nanoscale metallic materials integration. This technology enables precise thrust control and rapid shutdown capabilities, essential features for modern defense applications requiring operational flexibility unavailable in traditional solid rocket systems.

Validated Performance Through Strategic Partnerships

Critical validation of Firehawk's technology readiness comes through the NASA Stennis Space Center partnership, which involves testing their Armstrong 1K rocket engine. This partnership demonstrates the technology's transition from experimental to operational deployment, providing independent verification of performance claims and establishing credibility within the broader aerospace ecosystem.

The strategic partnership with Raytheon for research and development of future hybrid rocket propulsion technologies provides direct access to one of the largest defense contractors globally, offering both technical validation and a potential pathway to large-scale procurement contracts. This relationship significantly de-risks commercial adoption while providing insights into emerging defense requirements.

Market Dynamics and Explosive Growth Trajectory

Defense Technology Investment Reaches Inflection Point

The defense technology landscape has undergone fundamental transformation, with venture capital investment reaching a record $11.1 billion in the first half of 2025 alone, representing unprecedented acceleration from $2.7 billion annually just four years prior. This surge reflects both heightened global security concerns and the Pentagon's strategic pivot toward incorporating cutting-edge technologies into defense systems.

The rocket hybrid propulsion market, valued at $3.77 billion in 2024, is projected to reach $6.30 billion by 2033, growing at a robust 6.5% CAGR. This expansion is primarily driven by increasing demand for safer, more efficient propulsion systems that can support both defense and commercial space applications. Hybrid rockets offer the safety advantages of solid propellants combined with the performance characteristics of liquid systems, making them ideal for military applications where reliability and controllability are paramount.

Pentagon's Strategic Technology Priorities

The Department of Defense has allocated $25.2 billion specifically for AI and autonomous systems in FY2025, representing 3% of the total $850 billion defense budget. This commitment underscores the military's recognition that advanced propulsion technologies, particularly those enabling autonomous systems and precision-guided munitions, are critical for maintaining strategic superiority in an increasingly complex threat environment.

Government contracting patterns strongly favor small business innovation through SBIR/STTR programs. The Space Development Agency alone has made over 100 awards valued at more than $200 million to 65 unique small businesses, with FY2024 awards totaling $64 million across 54 companies. Firehawk's technology profile aligns precisely with Pentagon priorities for rapid prototyping, cost-effective manufacturing, and enhanced operational capabilities.

Strategic Oklahoma Facility and FISTA Integration

Firehawk's 40,000-square-foot manufacturing facility at Fort Sill, Oklahoma, supported by state and federal investment, demonstrates both public sector confidence in the technology and the company's commitment to scaling production capacity. This facility is specifically designed for advanced energetics and propulsion technologies for defense applications, positioning the company to meet anticipated military demand while benefiting from proximity to critical defense infrastructure.

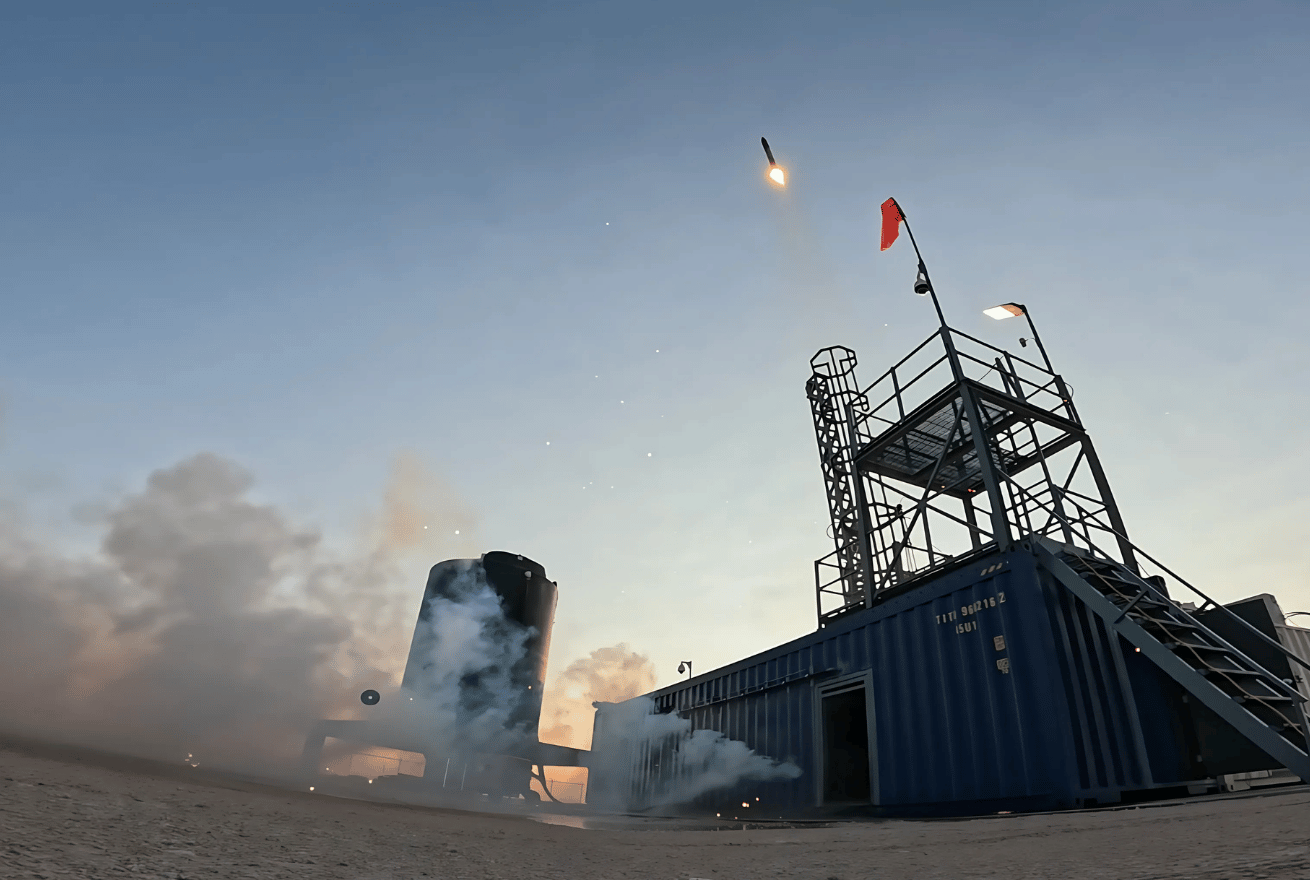

Figure: Modern aerospace manufacturing facility showing advanced aircraft assembly processes relevant to defense and commercial aviation production.

The FISTA (Fires Innovation Science and Technology Accelerator) ecosystem integration provides strategic advantages extending beyond geographic proximity, offering access to specialized talent, testing facilities, and direct coordination with military end-users. This positioning creates sustainable competitive advantages in serving government customers while reducing technology adoption barriers.

Competitive Positioning and Investment Rationale

Early-Stage Opportunity in Premium Valuation Environment

The defense technology sector's median revenue multiple of 17.4x exceeds even AI companies at 17.1x, indicating strong investor confidence and competitive valuations across the sector. However, while defense technology unicorns like Anduril ($30.5 billion valuation) and Shield AI ($5.3 billion valuation) command premium valuations, Firehawk represents an attractive early-stage investment opportunity with significant upside potential.

Firehawk Aerospace presents an attractive early-stage investment opportunity within the defense tech ecosystem, positioned for significant growth potential compared to later-stage unicorns.

Deep tech investments have historically outperformed traditional venture capital, generating average IRRs of 21% compared to 17% for conventional tech investments, with defense-focused technologies showing particular strength due to stable government demand and high barriers to entry. This performance differential reflects the strategic importance of defense technologies and the substantial competitive moats that protect established players.

Intellectual Property Protection and Competitive Moats

Firehawk's competitive advantages extend beyond core technology to encompass comprehensive intellectual property protection. The company has secured key patents on hybrid rocket engine fuel grains with compositional variations and additive manufactured thermoplastic-nanocomposite fuel systems, creating substantial barriers to entry for competitors. These patents cover critical aspects of the manufacturing process and fuel grain design, providing long-term protection for the company's technological differentiation.

The collaboration with JuggerBot 3D for large-format additive manufacturing systems addresses scalability concerns while maintaining the speed and precision advantages of their proprietary process. This partnership demonstrates Firehawk's ability to leverage external capabilities while protecting core intellectual property, a critical capability for scaling production efficiently.

Dual-Use Market Expansion and Risk Mitigation

The dual-use potential significantly expands addressable markets beyond defense applications. While defense applications provide initial revenue streams with predictable procurement cycles, the same 3D-printed propellant technology can serve commercial space launch, satellite maneuvering, and space tourism markets. This diversification reduces customer concentration risk while positioning Firehawk to capitalize on the broader space economy growth, projected to reach $1 trillion by 2040.

Financial Performance and Near-Term Value Creation

Funding Progression and Investor Confidence

Firehawk's funding progression demonstrates strong investor confidence and measured growth execution. The company has raised $88.3 million across six funding rounds, with the most recent $60 million Series C led by 1789 Capital significantly oversubscribed, indicating robust market demand for the investment opportunity. The grant from the State of Oklahoma in May 2025 provides additional validation of the technology's strategic importance while reducing dilution for equity investors.

Market timing favors near-term value creation, with defense tech funding reaching record levels in 2025 and a 92% probability of additional funding within six months for companies demonstrating Firehawk's growth profile. This probability reflects both the company's strong fundamentals and the current investment environment's appetite for defense technology opportunities.

Strategic Outlook

Firehawk Aerospace represents a high-conviction investment opportunity at the intersection of validated technology, expanding market demand, and strategic positioning within the defense ecosystem. The company's proprietary 3D-printed propellant technology addresses genuine performance and cost challenges while creating sustainable competitive advantages through intellectual property protection and operational expertise.

The convergence of defense modernization priorities, record venture capital investment in the sector, and Firehawk's demonstrated execution capabilities creates optimal conditions for value creation. The technology's proven performance through NASA partnerships, combined with strategic relationships and government support, positions the company for accelerated growth and premium valuation expansion.

Disclaimer: This analysis is based on publicly available information and proprietary research conducted by Opulentia Ventures LLC. Past performance does not guarantee future results. All investments carry risk of loss.