Executive Summary:

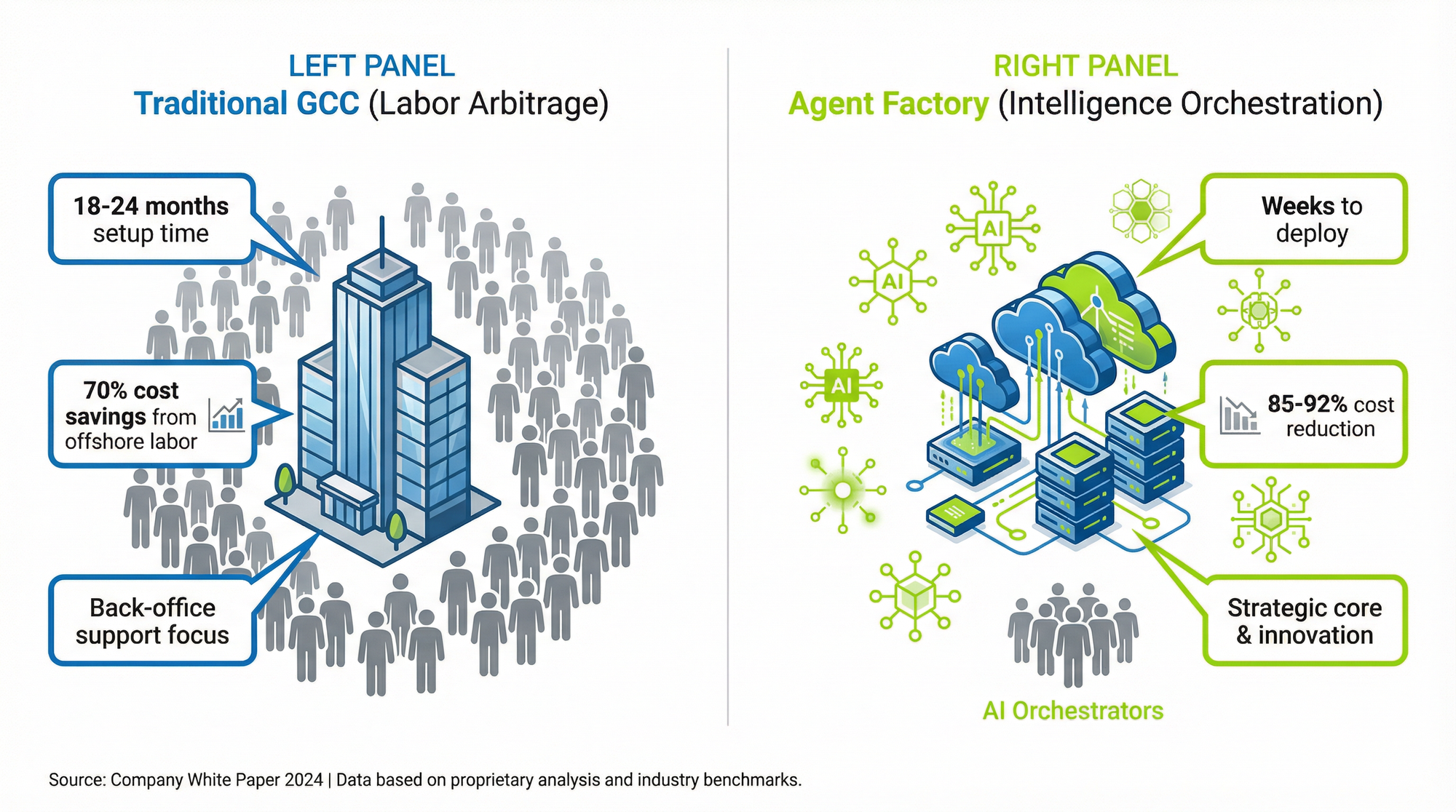

For years, high-tech companies followed a simple playbook when building Global Capability Centers (GCCs): find a less expensive location, bring in a large team of skilled workers, and enjoy huge savings—sometimes as much as 70%—on labor costs compared to their main office.

But in 2025, everything is changing. Agentic AI—autonomous AI agents that don’t just help, but actually act, make decisions, and handle tasks on their own—are rewriting the rules. Instead of building huge centers full of people, the new model focuses on “Agent Factories” that coordinate smart systems.

Here’s why the old GCC model is transforming —and how forward-thinking companies (and the investors backing them) are adapting fast.

- The Era of Labor Arbitrage Is Over

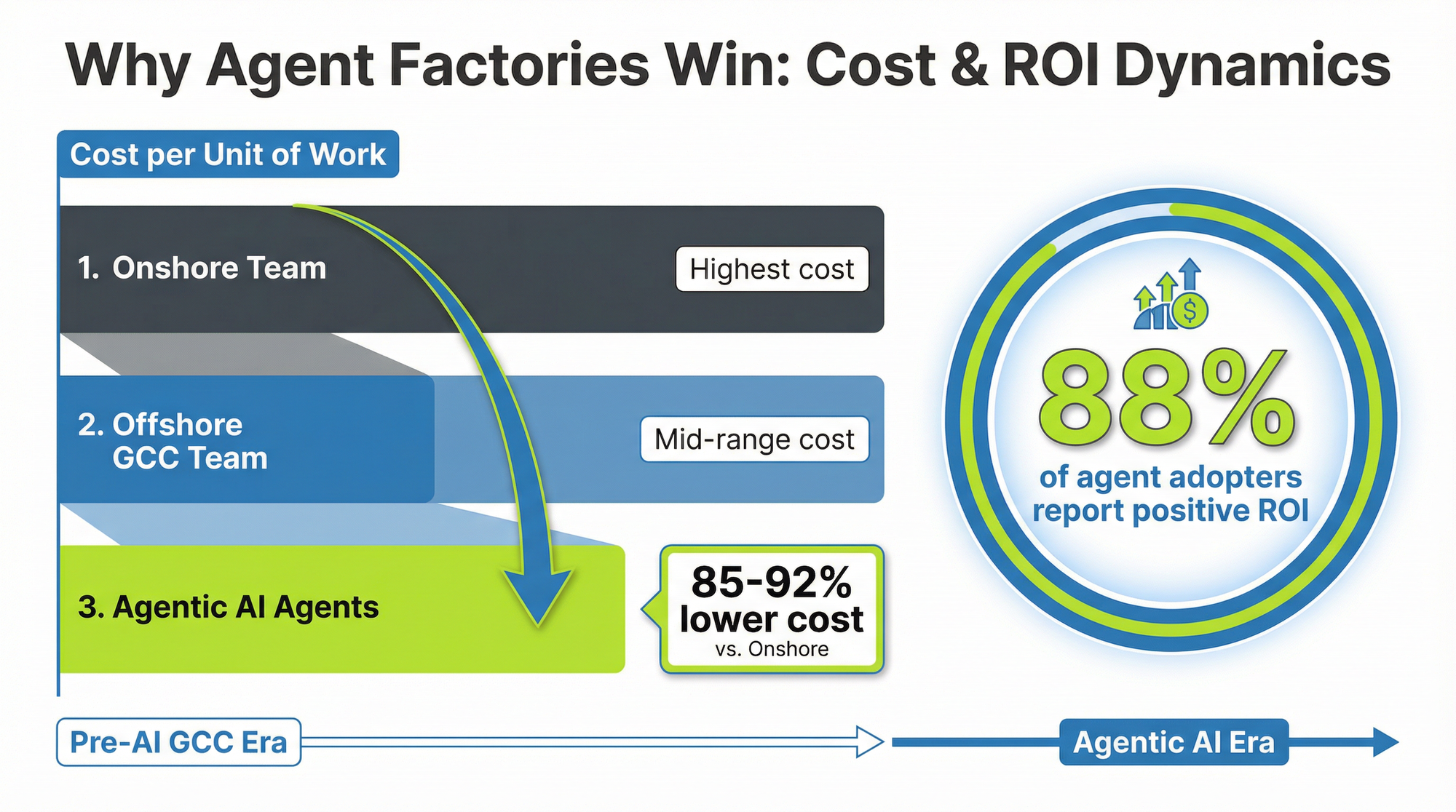

The classic GCC advantage boiled down to one thing: cheaper human labor in places like India or Eastern Europe. And the smart, autonomous AI systems can now do the same work at 85–92% less than what even the most cost-effective offshore teams charge. Take customer service as an example: an AI agent can handle a conversation for just 25 to 50 cents — literally pennies

— while a human employee (even one based offshore) still costs the company thousands of dollars every year in salary, benefits, training, and overhead. And the best part? The companies that jumped in early are already seeing real money back in their pockets. In 2025, 88% of businesses using these AI agents are reporting solid, positive returns on their investment. What used to be a smart cost-saving move (building big teams in low-cost locations) is quickly becoming an expensive way to stay competitive. The new competition isn’t person vs. person—it’s human vs. algorithm. When an API call costs pennies and delivers 24/7 performance, the value of a massive physical workforce disappears. - Big Headcount? Once a Strength, Now a Liability

Remember when leaders boasted, “Our GCC has 10,000+ employees”? That was a signal of power. Today, large teams can feel like corporate overhead. AI agents are projected to create hundreds of billions of dollars in the coming years, and many companies are already running them at scale. The real edge comes from non-linear scaling: a small group of elite “AI orchestrators” can now match (or exceed) the output of entire departments. We’re seeing the

rise of “Nano-GCCs”—lean, high-impact hubs laser-focused on R&D, AI innovation, and strategic oversight rather than mass operations. - Specialized Talent? AI Is Democratizing It

GCCs used to give companies access to experts at lower costs. Generative AI and open-weight frontier models have changed that equation forever. Today, 80%+ of companies use GenAI, and tools like AI-powered coding assistants make complex work accessible to generalists anywhere. Experise has been democratized to a large extent. The brainpower is shifting back toward headquarters. Leaders in regions like APAC see AI fueling a boom in generalist roles—augmented by AI, they can handle what once required niche specialists. - Speed Wins—And GCCs Are Too Slow

Traditional GCC setup typically takes 18–24 months of planning, hiring, and ramp-up. Worse yet, pre-built GCC for problems of yesterday create sunk cost effect. Agentic AI? It can go from concept to production in weeks—or even days. Companies like Klarna have already replaced the work of hundreds of agents with AI in just a month, gaining instant 24/7 coverage and faster results. With 93% of executives saying agent scaling will be a key differentiator in the next year, sticking to slow, traditional cycles means getting left behind.

The Winning Move: Build an “Agent Factory”

The GCC model isn’t dying—it’s evolving into something more powerful: an Agent Factory.

- Shift from back-office support to a strategic core (many mature GCCs are already investing heavily in agentic AI for decision-making).

- Move beyond cost savings to innovation arbitrage—creating proprietary AI models, data strategies, and IP that drive the entire company.

- Embrace a hybrid dual-engine model: AI agents handle routine, high-volume work while human-led teams own governance, safety, and differentiation.

In this new world, trust and security matter more than ever. As concerns about autonomous agents grow, the real advantage goes to those who build governed, enterprise-grade agent ecosystems—safe, reliable, and auditable.

The Bottom Line

In a world where 88% of agent adopters already see ROI, and 93% of leaders believe scaling agents in the next 12 months determines winners, measuring your GCC by headcount is a 2010 strategy surviving on borrowed time. The future belongs to Agent Factories—compact, governed, innovation engines built to orchestrate intelligence, not labor.

From an investor’s lens, this paper underscores a structural shift: value is moving away from simply locating talent more cheaply and toward owning the intelligence, orchestration, and governance layers that enable AI-native operations.

For Opulentia, that aligns closely with the focus on backing founders who treat automation, data, and security as core design principles rather than efficiency add-ons.

The move from traditional GCCs to what Sandeep describes as “agent-first” operating hubs creates a new class of companies that can scale revenue without linear headcount growth, which directly improves unit economics and resilience across cycles. This is precisely the profile sought in Opulentia’s investments in AI infrastructure, enterprise software, and mission-critical technologies, where durable value comes from compounding capability rather than expanding payroll.

For non-technical investors in our tribe, the practical implication is straightforward: when evaluating future opportunities, the question is less “where is the work done?” and more “how intelligently is the work orchestrated, protected, and measured?”

Opulentia’s mission is to allocate capital to those innovation engines—often smaller in headcount but richer in IP and operational leverage—that can partner with large enterprises and governments as they navigate exactly the transition this article describes.