2200 Words: 7 Minutes Read

I've spent the last decade watching BattleBots with my son and writing checks for frontier tech—AI infrastructure, combat drones, nuclear microreactors, quantum computing. I've also evaluated investments in Figure AI and Apptronik. But I want to be clear about something: those humanoid manufacturing investments should not be our framework for assessing, like F1, the entertainment funds the infrastructure, but the real value lies in robot fight leagues. They're separate opportunities entirely.

I'm also a lifelong car enthusiast who's always chased the latest automotive technology. And watching how Formula 1 functions as the R&D testbed for automotive innovation has given me clarity on what humanoid combat leagues are really about.

Here's why: Robot fight leagues are becoming something far more strategically valuable than a feeder system for humanoid manufacturers. They're becoming the public R&D testbed and benchmark infrastructure that every player in physical AI—Tesla, Figure, Apptronik, NVIDIA, OpenAI, the Pentagon—will ultimately depend on. That's a $10B–$50B+ opportunity, evaluated on its own terms.

The Formula 1 Blueprint: Why This Framework Changes Everything

If you follow F1, you know that the sport isn't primarily about entertainment—though it is entertaining. Formula 1 is the proving ground where every automotive technology is validated before it reaches production vehicles.

Think about it:

- Mercedes tests hybrid powertrains in F1 before deploying them in S-Class sedans

- Ferrari develops suspension systems on track before they appear in consumer Ferraris

- Aston Martin uses F1 aerodynamics research to inform hypercar design

- Pirelli develops tire compounds in F1 that later appear in road car tires

- And my personal favorite, McLaren, which uses Formula 1 as a testbed to finely tune its road cars for extreme weight reduction and maximum speed.

Every major automaker eventually enters Formula 1 because it's not optional—it's the proving ground for automotive innovation.

In my humble opinion, the same dynamic might happen with humanoid robots and physical AI.

Humanoid combat leagues can become Formula AI—the public testbed where every humanoid manufacturer, AI company, and defense contractor validates their technology before deploying at scale. And, like F1, the entertainment funds the infrastructure, but the real value lies in technology validation and data generation.

The Core Thesis: Humanoid Combat Leagues as Essential Infrastructure

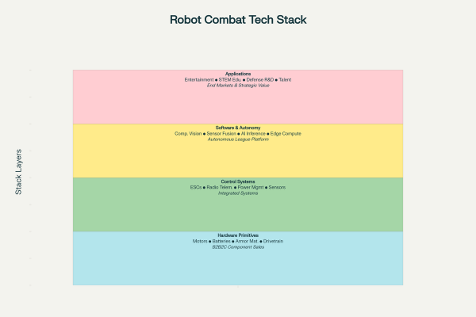

Most venture analysis treats robot fight leagues as entertainment or supply chains. That's too narrow. The real opportunity is that humanoid combat leagues are becoming the only place where physical AI stacks get tested in real-world adversarial scenarios at scale.

Here's what's actually happening:

Tesla is building 10 million Optimus units/year. Figure AI's BotQ scales toward 100,000 units/year. Apptronik is manufacturing Apollos globally. These companies can simulate falling a million times. They can test movements in controlled environments. But they cannot validate:

- How humanoid dexterity performs under unpredictable adversarial pressure

- How Gen AI decision-making stacks handle real-time strategy adjustments

- How embodied AI recovers from failures in uncontrolled environments

- How human-like behavior emerges when humanoids are forced to compete

Humanoid combat leagues answer all of these questions in public.

Just like F1 answers questions about automotive technology in real-world conditions—high speeds, extreme G-forces, unpredictable weather—that simulation alone cannot replicate. Every automaker wants to know: Does this suspension geometry work? Does this engine concept scale? How does hybrid power delivery perform under racing stress?

Humanoid manufacturers will eventually need the same validation. And they'll all show up.

Every humanoid manufacturer will eventually need this validation. Every AI company building embodied intelligence will need this benchmark. Every defense contractor planning autonomous systems will need this proof-of-concept. And right now, there's no independent, venture-backed player consolidating and monetizing this infrastructure.

The Market Opportunity: Two Separate But Connected Markets

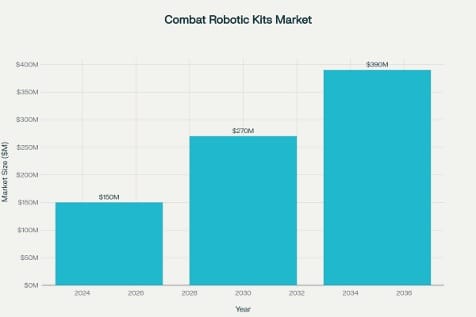

Market 1: The Humanoid Combat League Business Itself ($5B–$8B)

This is the league operations, media, sponsorships, component supply, and data licensing business. It's a genuine $5B+ opportunity with multiple revenue streams. (Entertainment and media, Component supply, Distributed manufacturing services, Embodied AI training data, Defense supply chain)

Total addressable market: $5B–$8B. This is evaluated independently of humanoid manufacturers.

Market 2: The Public Testbed Value That Every Physical AI Player Needs ($10B–$50B+ Capture)

This is where the real value lives—exactly like F1. Not every automaker enters F1 to make money from racing. They enter because F1 is where automotive innovation is proven and validated. The business model works because:

- Racing funds R&D: Sponsors pay billions to associate with F1 because F1 accelerates automotive innovation

- Technology trickles down: Innovations proven in F1 reach consumer vehicles and drive sales

- Supplier validation matters: Being an F1 supplier proves your product works at extreme conditions; that brand value translates to billions in road car contracts

The same applies to humanoid combat leagues:

Every company scaling humanoid robots needs validation data that:

- Proves dexterity works under pressure

- Validates embodied AI stacks

- Generates benchmark data

- De-risks humanoid deployment

- Proves human-like behavior

Companies willing to pay for this validation (like F1 sponsors):

- Humanoid manufacturers

- Semiconductor/compute companies

- AI companies

- Defense contractors

- Research institutions

Why Humanoid Combat Leagues Are a Separate Investment Thesis

This is critical: We should not evaluate humanoid combat league investments through the lens of Figure AI or Apptronik investments.

Why?

Figure AI and Apptronik are manufacturing companies. They scale if humanoid demand increases. Their returns depend on how many units they can ship. What margins can they achieve? How fast can they reach profitability?

Humanoid combat leagues are infrastructure companies. They scale if they become essential validation for the entire ecosystem. Their returns depend on whether they can become the trusted benchmark every player needs. Can they generate recurring revenue from data licensing? Can they capture switching costs through network effects?

This is exactly how F1 operates. Ferrari doesn't enter F1 to make money from racing—they lose money on F1 operations. They enter F1 because:

- F1 validates their technology (proving ground)

- F1 generates data that improves road cars

- F1 provides marketing value worth billions

- F1 is where automotive suppliers compete and prove themselves

These are fundamentally different businesses:

| Factor | Humanoid Manufacturers | Humanoid Combat Leagues |

|---|---|---|

| Revenue Model | Unit sales + services | Data licensing + sponsorships + media |

| Margin Profile | 20–40% (manufacturing) | 60–80% (software/data) |

| Capital Intensity | Very high ($billions) | Moderate ($50–200M) |

| Time to Scale | 5–10 years | 2–4 years |

| Strategic Value | Execution on manufacturing | Becoming essential infrastructure |

| Exit Multiple | 2–5x revenue | 10–20x revenue (software/data) |

| F1 Analogy | Road car manufacturers | F1 as sport and proving ground |

When we evaluated our investments in Figure and Apptronik, we were betting on humanoid manufacturing execution. When we invest in humanoid combat leagues, we're betting on infrastructure consolidation and network effects.

These should be separate theses.

The Business Model: Humanoid Combat Leagues as Standalone Infrastructure

Revenue Stream 1: Entertainment and Media ($200M–$500M by 2035)

Revenue Stream 2: Embodied AI Training Data ($500M–$2B by 2035)

Revenue Stream 3: Supply Chain and Component Services ($1.5B–$2.5B by 2035)

Revenue Stream 4: Defense and Strategic Contracts ($500M–$1B+ by 2035)

The Investment Opportunity for Opulentia: Four Entry Points

Option 1: The Autonomous Humanoid Combat League Operator(s)

Thesis: Operator(s) that build the first venture-backed autonomous humanoid combat league. Position as the independent, neutral testbed that every humanoid manufacturer and AI company needs.

F1 Analogy: This is the Formula 1 franchise.

Option 2: The Distributed Manufacturing and Component Supply Play

Thesis: Manufacturer (s) that build a vertically integrated component supplier and contract manufacturer serving humanoid combat leagues, humanoid manufacturers, and defense contractors. This is the Pirelli or Brembo of humanoid robotics.

F1 Analogy: Tier-1 F1 suppliers that dominate road vehicle markets

Option 3: The Entertainment and Media Consolidation

Thesis: Consolidate NHRL, BattleBots, and international leagues into a unified streaming platform with integrated sponsorship and data infrastructure. This is ESPN for humanoid robotics.

F1 Analogy: Media rights holder or broadcast operator

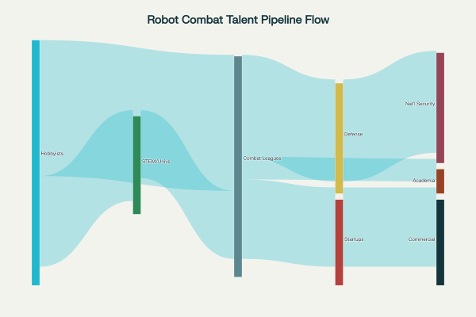

Option 4: The Defense Infrastructure and Talent Pipeline

Thesis: Formalize relationships between humanoid combat teams and defense contractors. Monetize through placement, consulting, and DARPA contracts. This is the talent scouting and technology transfer layer.

Why Now: The Convergence Window

Three factors create an urgent opportunity window (2025–2028):

- Humanoid Manufacturing Is Ramping Production

- Embodied AI Standardization Is Happening

- Defense Spending on Autonomous Systems Is Accelerating

The window to build the independent, neutral, venture-backed humanoid combat infrastructure is now. Just like the window to build F1 as an independent sport was limited, and eventually, major manufacturers took it over.

The Strategic Advantage: Why Opulentia's Thesis Differs From Our Humanoid Investments

When we evaluated investments in humanoid manufacturers, we made a manufacturing execution bet. Will they scale production faster than competitors? Will they achieve acceptable margins? Will they hit deployment timelines?

With humanoid combat leagues, we're making an infrastructure-and-network-effects bet. Will we become the trusted validation layer for the entire ecosystem? Can we create switching costs? Can we scale data licensing revenue?

These are different risk profiles:

- Manufacturer risk: Market adoption, manufacturing execution, competition from Tesla

- Combat league risk: Ecosystem adoption, network effects, standardization

But here's the key insight: Our humanoid manufacturing investments benefit from the existence of humanoid combat leagues. infrastructure-and-network-effects

This is precisely how F1 works: F1's value increases when more automakers compete—it validates the importance of the proving ground.

The Conclusion: Infrastructure Before Manufacturing

Venture capital often invests in manufacturers and hopes supply chains follow. We should invert that logic: Invest in the infrastructure that every manufacturer will eventually need.

Humanoid combat leagues are that infrastructure. They're becoming the public testbed, the benchmark suite, and the validation layer for the entire physical AI industry. Every humanoid manufacturer, every AI company, every defense contractor will eventually depend on them.

For Opulentia: This is a separate investment thesis from our humanoid manufacturing bets, but it's arguably more strategically valuable.

And hence I say "Let the Robots "Humanoids" Fight!"