The convergence of artificial intelligence and autonomous systems is fundamentally reshaping modern warfare, creating unprecedented investment opportunities in the defense technology sector. At the forefront of this transformation stands Shield AI, a company that has not only captured Silicon Valley's imagination but has also secured the trust of the Pentagon and allied forces worldwide. With a recent $5.3 billion valuation following its $240 million Series F funding round in March 2025, Shield AI represents the second-largest defense technology company by market capitalization, trailing only Anduril Industries. This discussion examines why Shield AI embodies the future of defense technology and presents a compelling investment opportunity in the rapidly expanding autonomous warfare market.

Defense Technology Market Growth Projections showing exponential growth in AI-driven defense segments from 2024-2030

The Strategic Imperative: Market Dynamics Driving Defense AI Adoption

The global defense landscape is experiencing a seismic shift driven by geopolitical tensions, technological advancement, and the urgent need for force multiplication capabilities. The global defense market is projected to grow from $541.1 billion in 2024 to $985.4 billion by 2030, representing a compound annual growth rate of 6.9%. However, the real opportunity lies in the exponential growth of AI-powered defense segments. The military artificial intelligence market is expected to surge from $13.24 billion in 2024 to $35.54 billion b

y 2030, exhibiting a remarkable 14.49% CAGR. Even more compelling is the autonomous drone market, which is projected to expand from $8.6 billion in 2024 to $27 billion by 2030, achieving a 17.8% CAGR. The most explosive growth is anticipated in AI-integrated drones, with the market set to grow from $658.6 million in 2024 to $2.75 billion by 2030—a staggering 27.4% CAGR.

Fundamental shifts in military doctrine and operational requirements underpin this growth trajectory. Modern warfare increasingly demands unmanned systems that can operate in GPS-denied, communications-contested environments where traditional human-piloted aircraft face significant limitations. The ongoing conflict in Ukraine has served as a real-world laboratory, demonstrating the tactical superiority of autonomous systems in electronic warfare scenarios. Defense budgets are being redirected toward these next-generation capabilities, with the U.S. Department of Defense alone committing over $150 billion to research, development, testing, and evaluation in fiscal year 2024, marking a 55% increase over the past five years.

Shield AI's V-BAT autonomous drone aircraft is shown in flight, highlighting its unique vertical takeoff and landing capabilities for defense applications.

Shield AI: Technology Leadership in Mission-Critical Autonomy

Shield AI's core technological advantage lies in its Hivemind platform, an AI-powered autonomy ecosystem that enables unmanned systems to operate independently without reliance on GPS or communications infrastructure. This capability represents a fundamental breakthrough in military aviation, addressing the most pressing challenge facing modern air operations: maintaining effectiveness in contested electromagnetic environments. Hivemind's modular architecture allows rapid integration across multiple aircraft platforms, from small quadcopters to fighter jets, providing unprecedented scalability and versatility.

The company's technology stack comprises four integrated components: EdgeOS (a specialized operating system), Pilot (prepackaged navigation algorithms), Commander (mission control interface), and Forge (development and simulation tools). This comprehensive suite addresses the entire autonomous system development lifecycle, positioning Shield AI not merely as a drone manufacturer but as the foundational software platform for the autonomous warfare ecosystem. The company has successfully demonstrated Hivemind's capabilities across nine different aircraft types, including the F-16 fighter jet, General Atomics MQ-20 Avenger, and Kratos MQM-178 Firejet, proving the platform's adaptability and military readiness.

Real-world validation has been extensive and impressive. Shield AI's Nova 2 quadcopter has been deployed in combat operations, while its V-BAT drone has been actively supporting Ukrainian forces against Russian surface-to-air missile systems. The company achieved a remarkable milestone by demonstrating autonomous air-to-air combat with an F-16 in partnership with DARPA's Air Combat Evolution program, with former Air Force Secretary Frank Kendall flying as a passenger during the autonomous dogfight demonstration. Such achievements underscore the maturity and reliability of Shield AI's technology in high-stakes operational environments.

A coordinated swarm of autonomous military drones flying over a defense testing environment, demonstrating advanced drone swarm technology.

Competitive Positioning and Strategic Partnerships

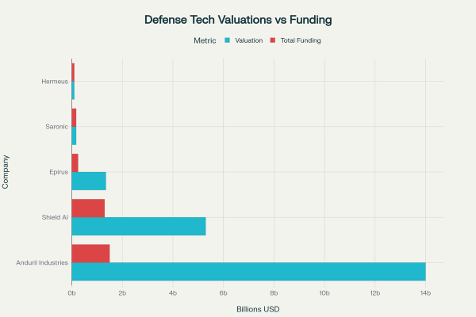

Shield AI operates in a dynamic competitive landscape dominated by defense technology unicorns and traditional aerospace giants. The company's primary competitor, Anduril Industries, commands a $14 billion valuation and focuses on a broader range of autonomous defense systems. However, Shield AI has carved out a distinctive niche in AI piloting software, creating a defensible moat through its platform-agnostic approach and proven multi-domain integration capabilities.

Defense Tech Unicorns: Valuations vs Total Funding comparison showing Shield AI as the second-largest defense tech company by valuation at $5.3B

The company's strategic partnership portfolio demonstrates its growing influence within the defense industrial base. Recent collaborations include transformative agreements with RTX Corporation for integrating Hivemind into loitering munitions and sensor systems, partnerships with Boeing and Airbus for expanding unmanned aerial capabilities, and alliances with L3Harris Technologies for electronic warfare applications. These partnerships validate Shield AI's technology while providing distribution channels into established defense supply chains.

Particularly noteworthy is the recent leadership transition that brought Gary Steele aboard as CEO in May 2025. Steele's track record includes founding and scaling Proofpoint to a $12 billion enterprise value and serving as CEO of Splunk before its $28 billion acquisition by Cisco. His appointment signals Shield AI's evolution from a defense startup to a technology platform company with broader commercial applications, potentially expanding the total addressable market beyond traditional defense contractors.

Financial Performance and Investment Thesis

Shield AI's financial trajectory reflects both its technological advancement and market opportunity capture. The company has raised $1.3 billion in total funding across 14 rounds, achieving a $5.3 billion valuation in its most recent Series F financing. The funding round's composition—featuring strategic investors L3Harris Technologies and Hanwha Aerospace alongside traditional venture capital firms—demonstrates strong industry validation and potential acquisition interest.

Revenue estimates place Shield AI in the $100-500 million range, indicating substantial commercial traction for its platform offerings[attached file]. The company's predicted 95% likelihood of future growth and 94% probability of additional funding within six months suggest robust financial health and continued expansion potential[attached file]. Unlike many defense startups that remain dependent on government contracts, Shield AI has developed a diversified revenue model encompassing software licensing, hardware sales, and service contracts across both defense and potential commercial applications.

The investment case for Shield AI rests on three fundamental pillars: technology leadership, market timing, and execution capability. The company possesses proven, combat-tested AI technology that addresses critical military requirements while maintaining platform agnosticism for broad market application. The timing aligns perfectly with unprecedented defense technology spending and the military's urgent need for autonomous capabilities. Most importantly, the recent leadership enhancement with Gary Steele's appointment provides the operational expertise necessary to scale the company from its current unicorn status to a potential IPO candidate or strategic acquisition target.

Risk Considerations and Future Outlook

Investment in Shield AI, like all defense technology ventures, carries inherent risks including regulatory scrutiny, ethical considerations surrounding autonomous weapons systems, and potential budget constraints affecting defense spending. The company operates in a politically sensitive sector where export controls and national security considerations may limit international expansion opportunities. Additionally, the defense procurement process remains notoriously slow and complex, potentially constraining revenue growth despite technological superiority.

However, these risks are substantially mitigated by Shield AI's diversification strategy and proven execution track record. The company's expansion into commercial applications, international partnerships, and platform-based business model reduces dependence on any single customer or market segment. Furthermore, the geopolitical environment and demonstrated effectiveness of autonomous systems in current conflicts create a sustained demand environment that supports continued investment and growth.

Looking forward, Shield AI is positioned to capitalize on the transformation of military aviation toward autonomous operations. The company's technology roadmap includes expanded swarm capabilities, enhanced AI decision-making algorithms, and integration with emerging technologies such as hypersonic systems and space-based platforms. As military forces worldwide grapple with the reality of peer and near-peer competition, Shield AI's autonomous piloting capabilities represent not just a technological advancement but a strategic imperative for maintaining military effectiveness in contested environments.

The convergence of artificial intelligence, autonomous systems, and modern warfare creates a generational investment opportunity in companies that can successfully navigate this complex landscape. Shield AI's combination of proven technology, strategic partnerships, experienced leadership, and substantial market opportunity positions it as a premier investment vehicle for accessing the future of defense technology. For investors seeking exposure to the autonomous warfare revolution, Shield AI represents a compelling opportunity to participate in the transformation of military aviation and the broader defense technology ecosystem.