A deep dive into the $290 billion market that’s quietly becoming the future of money.

As someone who has spent years analyzing emerging technologies and their potential to disrupt traditional markets, I can confidently say that stablecoins represent one of the most significant financial innovations of our time. What started as an experimental solution to cryptocurrency volatility has evolved into a $290 billion ecosystem that processed over $8.9 trillion in transactions in just the first half of 2025. To put this in perspective, that’s more transaction volume than most national payment systems handle in an entire year.

From Academic Experiment to Financial Infrastructure

The stablecoin story begins not with grand ambitions but with a simple problem: Bitcoin was too volatile to use as money. On July 21, 2014, two visionaries who would later become household names in crypto—Charles Hoskinson (founder of Cardano) and Dan Larimer (architect of EOS)—launched BitUSD on the BitShares blockchain. This pioneering digital asset aimed to maintain a 1:1 peg with the US dollar using crypto-collateralization mechanisms.

BitUSD was intellectually fascinating but practically flawed. The token relied on volatile BitShares (BTS) tokens as collateral, creating a house of cards that ultimately collapsed when BitUSD lost its dollar peg in 2018 and never recovered. The experiment taught the industry a crucial lesson: stability requires stable backing.

Enter Tether. Originally called “RealCoin” and launched just months after BitUSD in November 2014, Tether took a radically different approach. Instead of complex algorithms or volatile crypto assets, Tether promised something elegantly simple: for every USDT token issued, they would hold one real US dollar in reserve.

This “boring” approach would prove revolutionary.

The Duopoly That Rules Digital Money

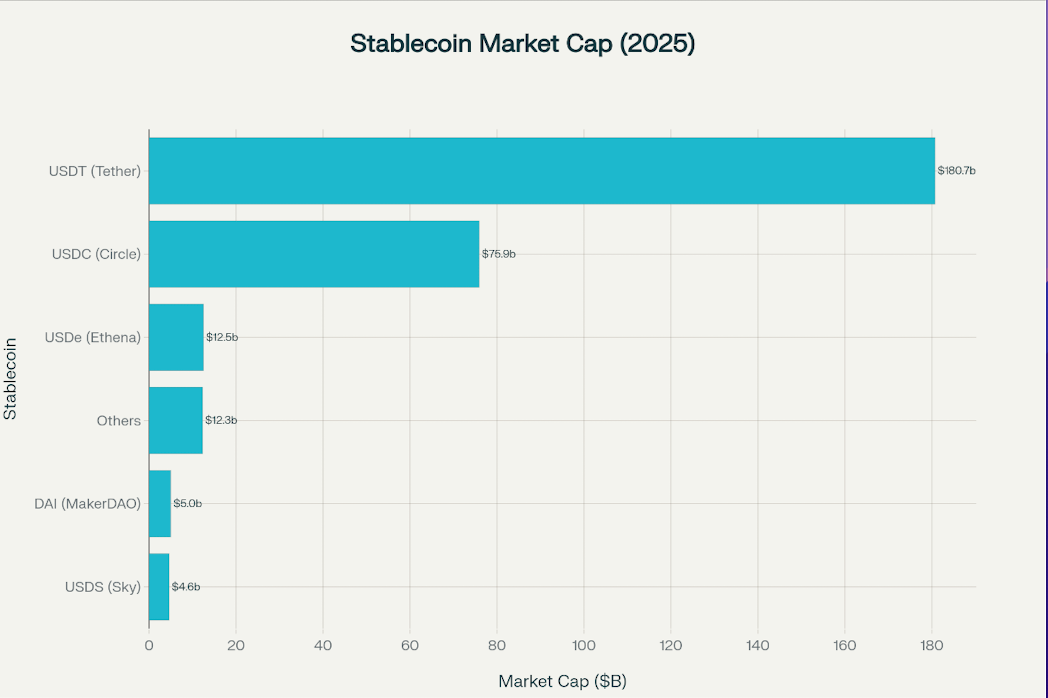

Today’s stablecoin landscape is dominated by two giants that have taken distinctly different paths to success. Tether (USDT) commands an astounding $180.7 billion in market capitalization—roughly 62% of the entire stablecoin market—while Circle’s USDC holds $75.9 billion, representing about 26%. Together, these two platforms process the majority of the world’s digital dollar transactions.Tether’s profit machine is staggering. In the first half of 2025 alone, Tether reported net profits of $5.7 billion—with $4.9 billion coming from Q2 alone. To understand the scale: Tether now holds over $127 billion in US Treasury securities, making it one of the largest holders of US debt globally, ranking alongside some nation-states. The company generates these massive profits primarily from interest income on reserves, with current yields above 5% on short-term Treasuries translating directly to bottom-line profits.

Circle chose the compliance route. While Tether prioritized growth and profitability, Circle focused on regulatory compliance and institutional trust. This strategy culminated in Circle’s historic IPO in June 2025, where the stock surged as much as 600% on the first day—the largest first-day pop for a billion-dollar US IPO in 30 years. Circle’s 2024 revenue exceeded $1.676 billion, with 95-99% coming from interest income on USDC reserves. However, Circle shares up to 50% of this interest income with institutional partners like Coinbase, prioritizing ecosystem sustainability over maximum profitability.

The divergent strategies reflect a fundamental tension in fintech: growth vs. compliance. Tether’s model maximizes profits but faces ongoing regulatory scrutiny, while Circle’s approach builds institutional trust but at the cost of margins. Both have found their markets, and both are thriving.

The Banking Revolution: Giants Awakening

The most significant development in 2025 has been traditional banking’s embrace of stablecoins. After years of skepticism, major US banks are now actively exploring joint stablecoin initiatives. According to reports from May 2025, JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo are in discussions through consortiums like Early Warning Services (which operates Zelle) and The Clearing House to launch a collaborative stablecoin.

This isn’t mere defensive positioning—it’s recognition of an existential threat and opportunity. JPMorgan has already launched JPMD, a deposit token on Coinbase’s Base blockchain for institutional clients. PayPal’s PYUSD has quietly integrated across its ecosystem, enabling everything from Venmo transfers to cross-border remittances through Xoom. Even American Express CEO Steve Squeri publicly acknowledged that stablecoins are “a good alternative to ACH and Swift payments”.

Why Stablecoins Will Become the Future of Currency

From my perspective as a venture capitalist, stablecoins are positioned to fulfill cryptocurrency’s original promise: becoming actual money. Here’s why they’re uniquely positioned to succeed:

- Instant Global Settlement : Traditional international transfers are embarrassingly slow. A payment from New York to Manila still takes 3-5 business days in 2025. Stablecoins settle globally in seconds, 24/7/365.

- Dramatic Cost Reduction : Cross-border payments via traditional rails average 3-7% in fees. Stablecoin transfers cost under 0.1% in most cases.

- Financial Inclusion at Scale: With just a smartphone and internet connection, anyone can access dollar-denominated stablecoins. No bank account, credit check, or minimum balance required.

- Programmable Money: Unlike traditional currency, stablecoins can be programmed with smart contracts, enabling automated payments, escrow services, and complex financial instruments impossible with conventional money. This programmability is already powering the $200+ billion DeFi ecosystem.

- Regulatory Clarity

: The passage of the GENIUS Act in July 2025 provided the federal regulatory framework the industry desperately needed. This legislation establishes clear rules for stablecoin issuers while protecting consumers, giving institutional players the confidence to enter the market at scale.

Monthly trading volumes have reached $1.48 trillion, up 27% year-over-year. USDT and USDC combined processed $23 trillion in trading volume in 2024—a 90% increase from 2023. Yet stablecoins still represent less than 2% of outstanding US Treasury Bills, indicating massive room for growth.

Erebor Capital: The First Mover’s Charter

The most significant regulatory development of 2025 came on October 14th when the Office of the Comptroller of the Currency (OCC) granted conditional approval to Erebor Bank—the first de novo bank charter approved under the current regulatory regime.

Founded by Palmer Luckey (Anduril founder) and Joe Lonsdale (Palantir co-founder), with backing from Peter Thiel’s Founders Fund, Erebor represents a new breed of financial institution. The bank explicitly plans to serve cryptocurrency companies, AI startups, and defense contractors—precisely the market segment left under served after Silicon Valley Bank’s collapse in March 2023.

The Road Ahead: Challenges and Massive Opportunities

While the stablecoin revolution appears unstoppable, significant challenges remain:

- Regulatory Fragmentation: Despite US clarity through the GENIUS Act, global approaches vary. The EU’s MiCA framework differs substantially from US regulations, creating complexity for global operators.

- Reserve Transparency: Questions persist about backing quality, particularly for Tether despite regular attestations. Circle’s monthly public reports and quarterly audits set a higher standard that others may need to match.

- Monetary Sovereignty: As USD-backed stablecoins proliferate globally, concerns grow about “digital dollarization” undermining local currencies—a 21st century version of colonial monetary policy.

- Technical Infrastructure: Blockchain scalability, smart contract security, and cybersecurity remain ongoing challenges as transaction volumes explode.

Yet the opportunities dwarf the risks. McKinsey projects stablecoin supply reaching $1.4 trillion by 2030. Major payment networks Visa and Mastercard are integrating stablecoins into their infrastructure. American Express, JPMorgan, and other financial giants are building products around stablecoin rails.

The Great Convergence: Traditional Finance Meets Digital Innovation

As I analyze market trends and investment opportunities, one conclusion becomes inescapable: stablecoins represent the great convergence of traditional and digital finance. They’re not replacing banks—they’re forcing banks to evolve. They’re not undermining the dollar—they’re extending its global reach through digital rails.

The recent moves by banking consortium's, regulatory clarity through the GENIUS Act, and pioneering institutions like Erebor Bank all point to the same outcome: stablecoins are graduating from crypto curiosity to critical financial infrastructure.

Conclusion: Money’s Digital Destiny

We’re witnessing the most significant monetary innovation since the creation of central banking. Stablecoins combine the stability of fiat currency with the efficiency of digital systems and the programmability of software. They enable instant global settlement, financial inclusion at scale, and cost reductions that seemed impossible just years ago.

The $290 billion stablecoin ecosystem processing trillions in annual volume isn’t a speculative bubble—it’s the foundation of tomorrow’s financial infrastructure.

As we look toward 2030, the question isn’t whether stablecoins will transform finance—it’s how quickly that transformation will occur and who will emerge as the dominant players. The convergence is happening now, the infrastructure is being built, and the regulatory framework is solidifying.

The stable in “stablecoin” doesn’t just refer to price stability; it represents the stable foundation upon which the next generation of global finance will be built.