$46 billion by 2035. Critical infrastructure under coordinated attack. Late-stage investments that will generate outsized returns.

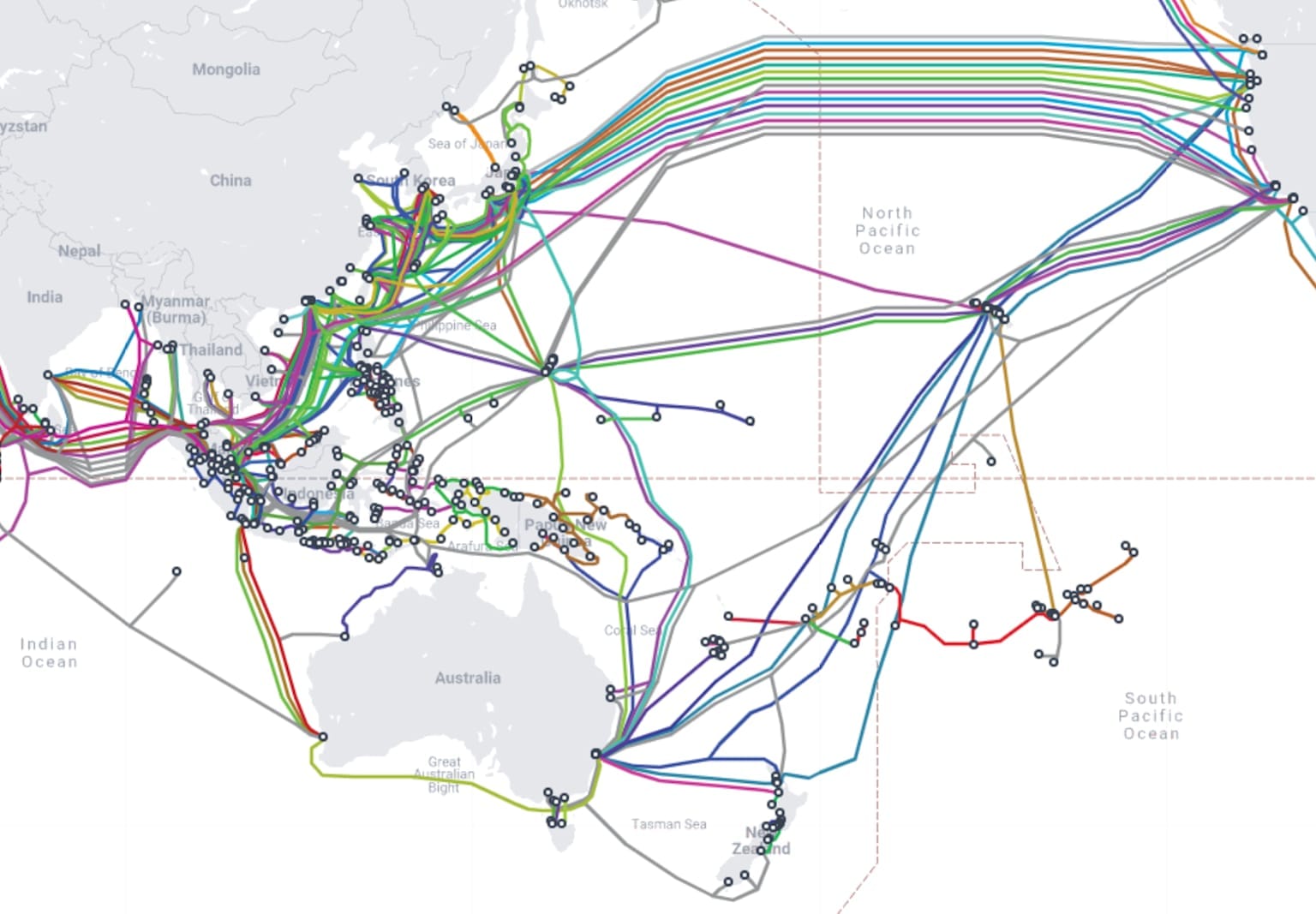

Undersea cables are being severed in coordinated campaigns—seven cuts in the Baltic Sea over a three-month period, five incidents in Taiwan's waters in eight weeks. Purpose-built vessels with industrial grinding equipment capable of cutting fiber-optic infrastructure at 4,000 meters depth have been unveiled publicly. NATO has launched its first-ever mission dedicated solely to protecting what 99% of the world's digital traffic depends on: the ocean floor.

This is not a future threat scenario. This is an operational reality.

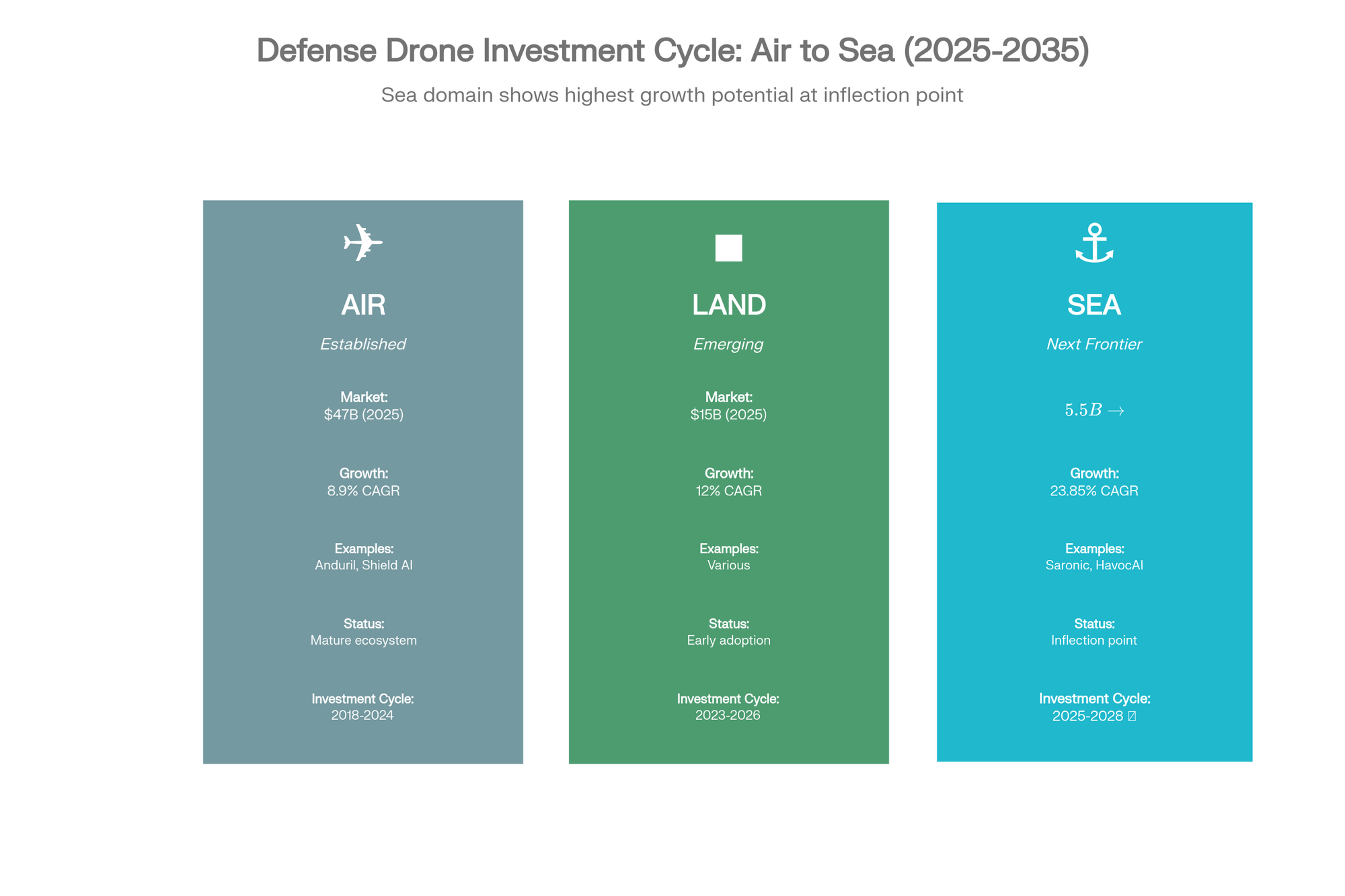

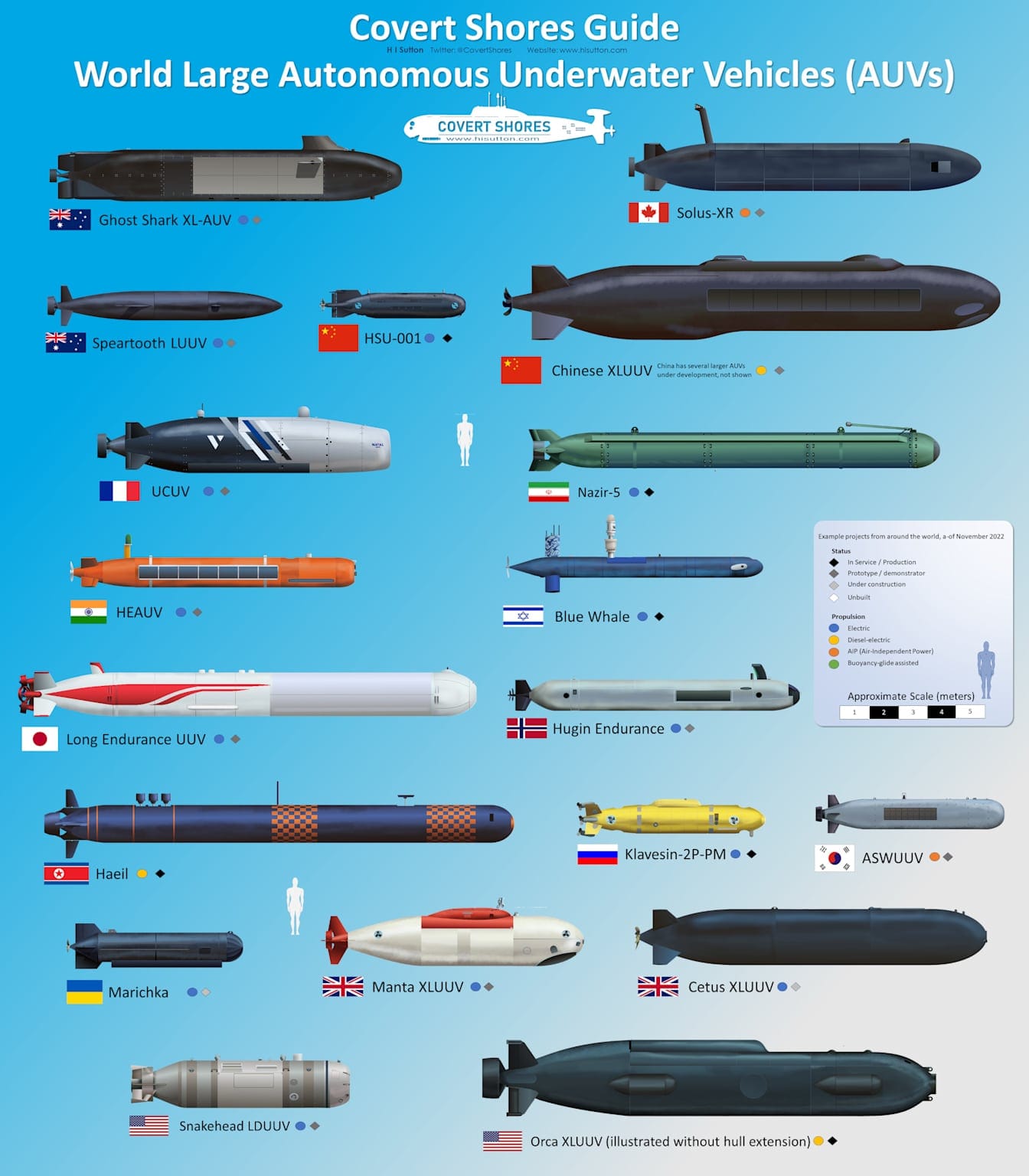

While defense technology attention remains focused on aerial drone milestones—a domain where investments in companies like Anduril and Shield AI have validated the thesis—a far more consequential transformation is unfolding beneath the surface. Adversaries are deploying autonomous underwater vehicles the size of submarines with 10,000-nautical-mile ranges. They're testing AI-powered sensor networks designed to eliminate America's submarine stealth advantage. And they're demonstrating capabilities in public—cable-cutting ships, autonomous minelaying platforms, distributed sensor webs—that make it clear: the undersea domain is now contested, and the advantage belongs to whoever can deploy persistent, autonomous systems at scale first.

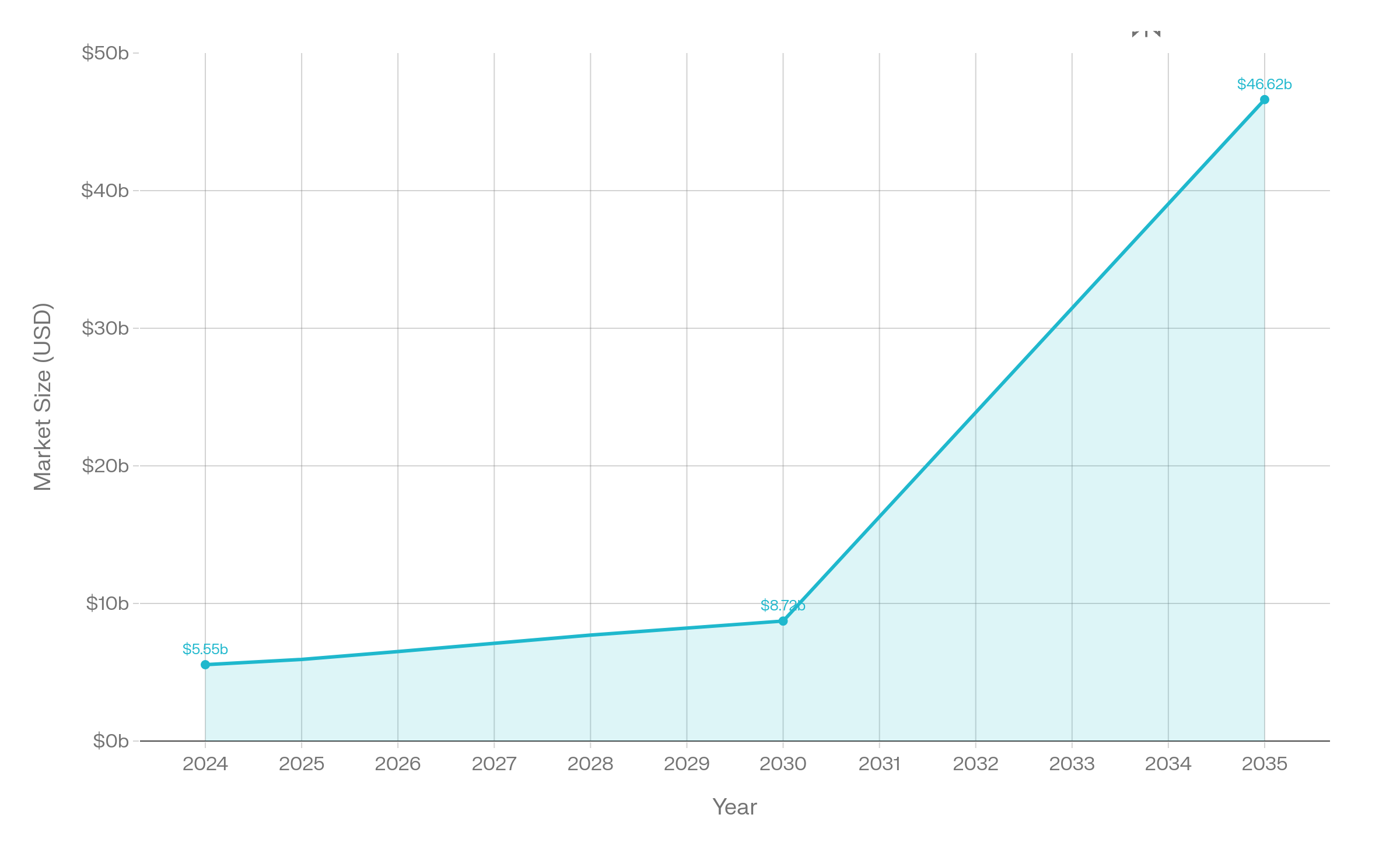

This is production-scale procurement. For late-stage investors, it represents the same inflection point aerial drones hit in 2020-2023—except with faster deployment timelines, higher growth rates, and significantly less competition. At Opulentia, we identify capital deployment cycles before consensus. Maritime autonomous systems are at that threshold now: $46 billion by 2035, growing at 23.85% CAGR versus 8.9% for aerial systems.

The undersea domain is where modern warfare will be decided—through persistent, distributed operations that establish information dominance, protect critical infrastructure, and hold adversary assets at risk.

Defense: Protecting What 99% of Commerce Depends On

Undersea cables carry 99% of intercontinental digital traffic. The South China Sea handles one-third of global maritime trade. A coordinated attack could digitally isolate regions, crash markets, and degrade military command networks in hours.

The solution is persistent, autonomous surveillance at scale. Long-endurance autonomous surface vessels that operate for months without refueling can continuously monitor tens of thousands of square nautical miles. The economics are transformative: crewed patrol vessels cost $50,000-$100,000 per day; autonomous platforms cost $2,000-$5,000 per day and stay on station for 3-6 months or even longer.

Offense: Contesting Adversary Freedom of Maneuver

Adversaries are building "Transparent Ocean" sensor networks spanning the seabed to space to track American submarines in real-time. The counterstrategy is to deploy distributed autonomous fleets that conduct ISR, anti-submarine warfare, electronic warfare, and kinetic strikes at 1/100th the cost.

Admiral Paparo describes this as an "unmanned hellscape"—thousands of autonomous platforms in contested waters to slow, track, and attrit adversary forces. Small vessels (6-40 feet) monitor chokepoints with overlapping sensor coverage. Medium vessels (40-150 feet) conduct persistent ASW patrols. Large vessels (60-180 feet) carry anti-ship missiles and electronic warfare systems.

The strategic advantage is overwhelming numerical superiority. An adversary submarine costing $2 billion faces 100 autonomous ASW platforms at $10 million each, operating persistently across transit routes.

The Market: $46 Billion by 2035

The unmanned underwater and surface vehicle market grows from $5.5 billion in 2024 to $46.6 billion by 2035—a 23.85% CAGR. Four distinct value layers:

Platform Manufacturing: Companies building autonomous vessels (6-180 feet) with vertical integration—hulls, propulsion, autonomy software, and mission control in-house. Late-stage companies are raising $100-200M at $3-5B valuations, with $200-400M in Navy contracts and paths to $500M+ in annual revenue in 36 months. Gross margins: 45-55%.

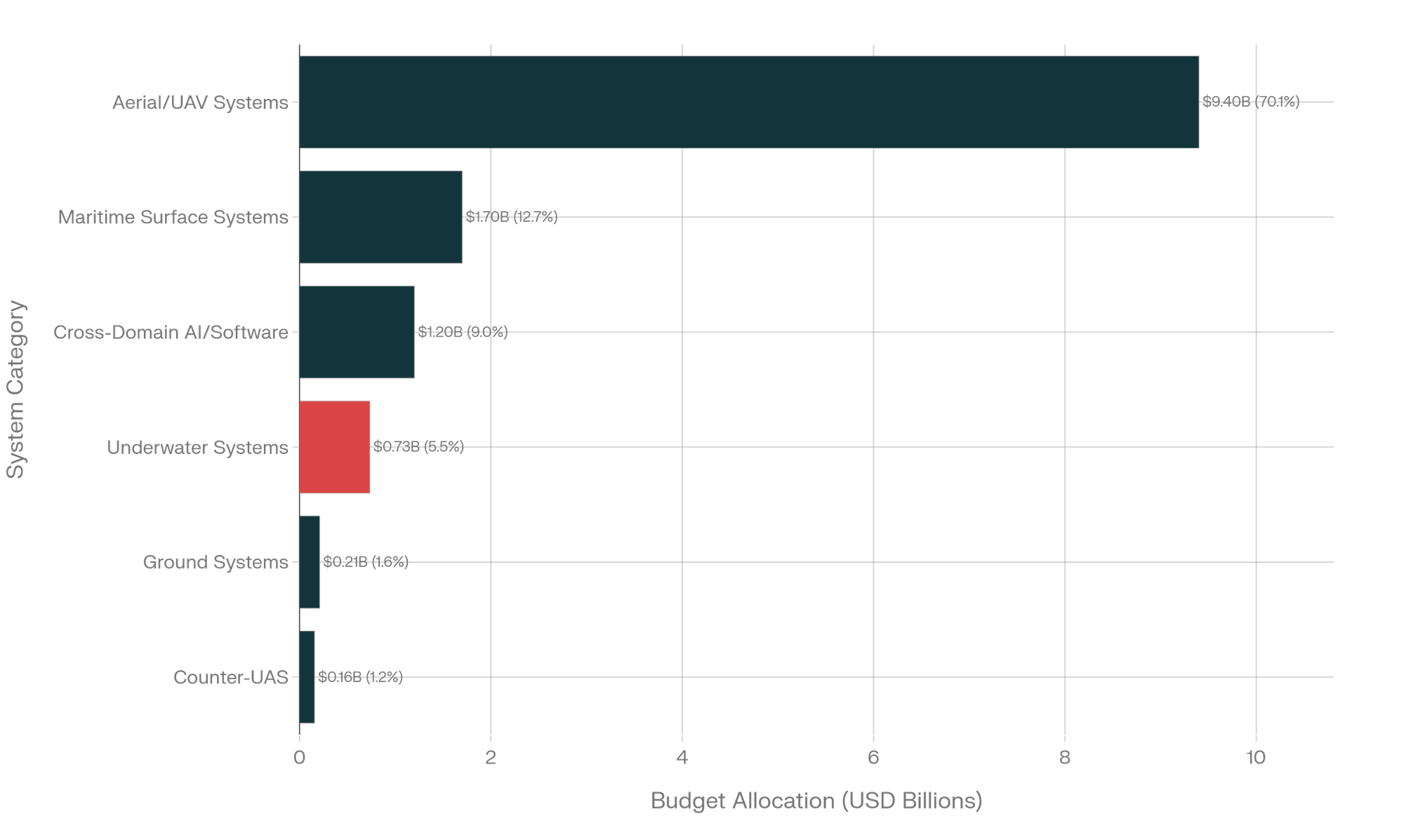

Autonomy Software: AI enabling one operator to manage dozens of vessels with adaptive path planning, sensor fusion, and collaborative execution. Pentagon allocated $1.2 billion for cross-domain autonomy software in FY2026. Once certified, stacks license across platforms, creating recurring revenue.

Sensors & Payloads: Advanced radar, electro-optical cameras, acoustic arrays, electronic warfare suites. Dual-use applicability—Navy ISR sensors sell to offshore energy operators, cable companies, and coast guards. TAM: $17.3 billion by 2035. Gross margins: 60-70%.

Infrastructure & Services: Persistent maritime domain awareness as a service. Companies deploy autonomous fleets that deliver continuous intelligence feeds, with revenue based on coverage area, not hardware sales. TAM: $12-18 billion by 2033.

Why Now: The Opulentia Late-Stage Investment Thesis

At Opulentia, we focus on late-stage opportunities where technology maturity, market readiness, and capital deployment cycles align to create outsized returns with compressed timelines. Maritime autonomous systems meet every criterion:

Technology Is Proven, Production Is Scaling

Companies have delivered operational platforms to the Navy with multi-month sea trials demonstrating reliability. The Navy deploys these systems with operational strike groups this month. Three unmanned squadrons stand up in 2026. The question is: who captures production contracts at scale for thousands of units?

Deployment Timelines Are 18-24 Months

The Replicator program aims to field autonomous systems within 18-24 months. Companies signing contracts in Q1 2026 deploy operational platforms by Q3 2027. Series C/D companies reach $300-500M revenue in 36 months, creating paths to $3-6B exits in 4-5 years.

The Capital Window Is Open Now

The Navy allocated $1.7 billion for maritime autonomous procurement in FY2026—the largest single-year investment ever. Contracts worth $200-400M are being awarded this quarter. Companies winning these gain operational validation, mission data for AI models, and procurement momentum.

What We're Evaluating: Late-Stage Readiness

Our approach to maritime autonomous systems focuses on Series C and Series D opportunities across platform manufacturers, autonomy software providers, and infrastructure-as-a-service models. At this stage, technology validation is table stakes—Opulentia invests in execution at scale, not potential.

The Conclusion: The Capital Wave Is Forming

The silent war beneath is not a future scenario—it is an operational reality. Undersea cables face coordinated attacks. Sensor networks are deployed at theater-scale. NATO has launched dedicated protection missions. The U.S. Navy has committed unprecedented resources to autonomous systems, with maritime platforms as the highest priority.

The aerial drone investment cycle demonstrated how capital positioned ahead of Pentagon procurement generates exceptional returns. The maritime autonomous cycle exhibits the same inflection characteristics—with superior fundamentals: faster deployment timelines, higher growth rates, lower competitive density, and clearer paths to multi-billion-dollar exits.

Institutional investors who understand defense capital deployment cycles recognize maritime autonomous systems as the most compelling opportunity since the first wave of aerial autonomy. The technology has proven operational reliability. Pentagon procurement dollars are flowing at production scale. The strategic imperative is absolute—contested waters demand persistent, distributed autonomous capabilities that traditional naval platforms cannot economically deliver.

Companies that capture initial production contracts during this transition window will define the market structure for the decade ahead. Capital deployed at the inflection point—when technology validation meets scaled procurement—generates asymmetric returns. Capital deployed after market structure crystallizes pays premium valuations for diminished upside.

The question facing defense technology investors is not whether maritime autonomy will transform naval warfare—the Pentagon has already made that decision. The question is whether capital positions strategically within deployment cycles or follows consensus into compressed returns. The infrastructure protecting 99% of global digital traffic, the chokepoints handling one-third of maritime trade, and the undersea domain where great power competition is being decided all depend on autonomous systems operating at scale. Investors who recognize inflection points in defense procurement—when operational validation meets scaled budget allocation—capture disproportionate value creation. Those who wait for market consensus pay premium valuations for diminished upside.