OpenAI's $500 billion valuation represents more than another Silicon Valley milestone—it signals a fundamental transformation in how value is created and realized in the modern economy. This unprecedented valuation, achieved through secondary markets rather than public offerings, exemplifies the shift toward private markets as the primary venue for the development of high-growth companies. A very close follower is Anthropic, now valued at $206.0 billion and expected to raise funds soon at a significantly higher valuation.

(Anthropic is an Opulentia Portfolio Company)

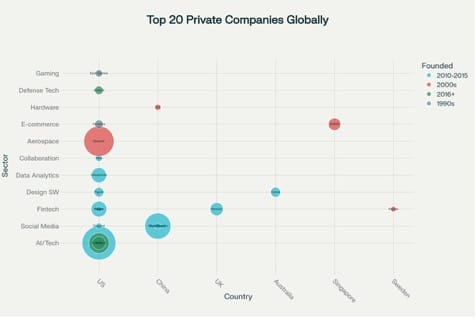

The World's Most Valuable Private Companies

A Global Landscape of Innovation

The Scale of Private Market Transformation

Record-Breaking Growth Metrics

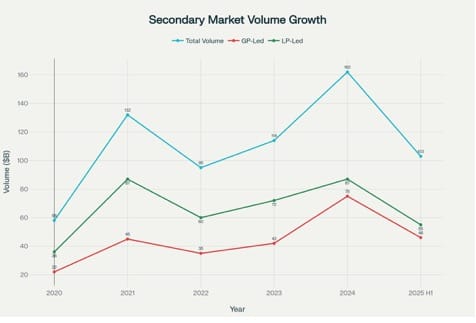

Secondary market transaction volume reached a historic $103 billion in the first half (“H1”) of 2025, representing a 51% increase from the previous year. Over 80% of continuation investment volume in 2024 was driven by fundamental structural shifts rather than temporary conditions. OpenAI's $500 billion valuation was achieved through a secondary share sale, allowing employees to sell $6.6 billion in stock to institutions including SoftBank, Thrive Capital, and Abu Dhabi's MGX.

GP-led transactions reached $46 billion in H1 2025, roughly 60% higher than in 2024, while LP-led transactions contributed $55 billion. Dedicated secondary capital reached $302 billion in H1 2025, up from $288 billion at year-end 2024, with secondary allocations representing 8.9% of total private capital raised in 2024, up from just 2.7% in 2021.

Secondary Market Transaction Volume Growth (2020-2025 H1)

Artificial intelligence companies have become the primary drivers of private market growth

Secondary Markets: The New Liquidity Solution

The continuation of the investment market is forecasted to quadruple from $70 billion to over $300 billion within the next decade. Companies now wait an average of 16 years to go public, up from 12 years a decade ago. In 2024, proceeds from secondary tender offers surpassed those from venture-backed IPOs. Only 18 U.S. companies completed IPOs through June 2025, with 10 of them being unicorns.

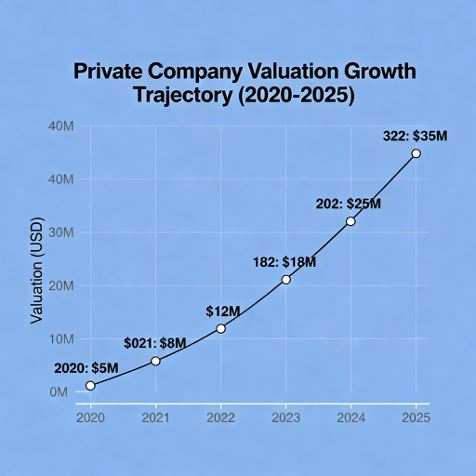

Fourteen private companies now exceed the median S&P 500 market cap, with over 1,270 unicorns holding $3.3 trillion in total value. Companies like ByteDance generated $155 billion in revenue at a $300 billion private valuation, while SpaceX commands a valuation of $400 billion, despite not having public filings. Recent growth includes Canva jumping from $32 billion to $42 billion and Revolut from $45 billion to $75 billion.

Private Market Evolution

The Rise of Super-Valued Companies

Geographic and Sectoral Dominance

The geographic concentration of private market value remains heavily skewed toward the United States, which hosts 760 of the world's unicorns and claims over 61% of total new US unicorn valuations.

US Market Leadership

The United States hosts 760 of the 1,565 global unicorns, accounting for 61% of the total valuations. In AI specifically, US companies captured 64% of international funding totaling $52.3 billion in 2024. The San Francisco Bay Area alone maintains 190 unicorns. However, Europe showed 41% year-over-year growth in AI funding, while China maintains 343 unicorns despite regulatory challenges.

Industry Concentration

Technology companies account for 45% of venture capital funding. The top 5 private companies—OpenAI ($500B), SpaceX ($400B), ByteDance ($300B), Anthropic ($183B), and Stripe ($106.7B)—collectively hold nearly $1.3 trillion in value. Defense and aerospace have emerged as significant sectors, with SpaceX at $400 billion and Anduril at $30.5 billion.

Of the top 50 most valuable private companies, 14 didn't exist five years ago, 36 are US-based, and over 40% are AI companies. Of 795 active unicorns with $3.3 trillion combined valuation, 372 operate in sectors favored by current policy priorities, representing $2.5 trillion in value.

Market Maturation and Institutional Adoption

The rise of evergreen retail vehicles has democratized private market access, contributing significantly to the $103 billion H1 2025 secondary market activity. Advanced technology platforms like Nasdaq Private Market have facilitated billions in transactions while improving efficiency and transparency.

Seven straight quarters of secondary market growth demonstrate the structural nature of this transformation. Research by Meketa Investment Group shows private and public valuations historically move together, with current convergence following pandemic-era disruption. However, concerns persist that over half of existing unicorns may lose billion-dollar status as valuations recalibrate.

Regulatory and Policy Framework

The SEC has introduced new rules for overseeing private funds, particularly those related to continuation funds. Current policy focus on AI, cybersecurity, robotics, and space technology has created favorable conditions for private companies in these sectors. This alignment between policy priorities and private market concentration has significant implications for economic growth and national competitiveness.

Future Implications

The systematic extension of private company lifecycles, dramatic secondary market growth reaching over $100 billion in H1 2025, and concentration of $5.2 trillion in unicorn value within private ecosystems represent permanent structural changes in global finance. Traditional public market-heavy allocations may prove inadequate for capturing value being created within private markets.

Generative AI funding in H1 2025 already surpassed the total 2024 levels, while the development of sophisticated secondary market infrastructure provides liquidity without public market constraints. The integration of advanced technology platforms has significantly improved transaction efficiency, supporting more efficient price discovery and reducing costs.

Conclusion: Permanent Market Evolution

OpenAI's $500 billion milestone—making it the first half-trillion-dollar private company—symbolizes broader permanent changes in global finance. The achievement of $1.3 trillion in combined value among just the top 5 private companies, alongside the development of a $103 billion H1 2025 secondary market, represents unprecedented concentration of innovation and capital within private ecosystems.

This transformation reflects fundamental changes in value creation, where private markets' ability to support longer development cycles and provide patient capital has proven particularly valuable for transformational innovation. As the private markets revolution continues, understanding and adapting to these new realities will be essential for all participants in the global economy.

Opulentia’s tribe-based approach to secondary market investing harnesses community intelligence and collaborative due diligence to identify and act on the best opportunities in today’s evolving landscape. By pooling the expertise and insights of our network, Opulentia ensures investors gain diversified access to mature, high-growth private companies—unlocking liquidity and value that traditional strategies might miss. This model directly aligns with the current trend toward secondary transactions, positioning our investors to thrive as private markets reshape the future of innovation and capital allocation.

For more insights on our investment philosophy, visit opulentia.vc and perspectives.opulentia.vc.